In this modern landscape of financial markets, investors are continually seeking ways to optimize their portfolios and manage financial risk effectively. One key aspect of a well-rounded investment strategy is diversification across asset categories, and bonds play a crucial role in achieving this goal. While stocks often take center stage in investment discussions, the inclusion of bonds and asset allocation can provide stability, income, and enhanced market risk management. We will explore how bonds can bolster your investment diversification strategies, drawing insights from recent strategic moves, such as Vista Land's, that exemplify the impact of well-planned financial decisions.

Understanding Investment Diversification

Diversification is the practice of spreading investments and mutual funds across various asset classes to reduce risk and enhance the potential for returns. The underlying principle is that each different asset class may not move in tandem, and by holding a mix of investments, the overall portfolio risk is mitigated. Historically, a traditional diversified portfolio has consisted of a combination of stocks, domestic and international stocks, and bonds. Indeed, investing involves risk and by diversifying all your money will mitigate the risk of loosing it.

Why is diversification important to have in investments?

Diversification is a fundamental principle in investment management, and its importance cannot be overstated. Here are several compelling reasons why investors should prioritize diversification in their investment portfolio:

1. Risk Mitigation

The primary objective of diversification is to reduce the impact of any single investment's poor performance on the overall portfolio. Different asset classes, such as stocks, bonds, and real estate, have distinct risk profiles and respond differently to market conditions. By holding a variety of investments, investors can cushion the impact of a downturn in any one sector.

2. Enhanced Consistency

Diversification promotes more consistent and stable returns over time. While individual investments may experience periods of volatility or underperformance, a diversified portfolio is better positioned to weather market fluctuations. This consistency during market volatility can provide investors with a more predictable investment experience and help them stay committed to their long-term financial goals.

3. Opportunity for Growth

Diversification allows investors to participate in various market opportunities. Different sectors and asset classes may outperform or underperform based on economic conditions, and having a diversified portfolio ensures that investors have exposure to a range of potential growth areas. This flexibility enables investors to capitalize on emerging trends and adapt to changing market dynamics.

4. Income Generation

Diversifying across asset classes, particularly incorporating income-generating assets like bonds, provides investors with a reliable income stream. This is crucial, especially for those seeking regular cash flow, such as retirees. Income generated from bonds and other fixed-income securities can act as a stabilizing force, supporting the overall financial well-being of investors.

5. Reduced Volatility

Diversification helps mitigate portfolio volatility. While certain investments may experience sharp price movements, a well diversified portfolio tends to exhibit smoother overall performance. By spreading investments across different assets, the highs and lows of individual holdings are balanced, resulting in a more controlled and less volatile portfolio.

6. Adaptability to Market Changes

Financial markets and other investments, are dynamic and can be influenced by various factors, including economic conditions, geopolitical events, exchange traded funds, and technological advancements. A diversified portfolio is better equipped to adapt to these changes, as different assets may respond differently to evolving market trends. This adaptability is essential for long-term investment success.

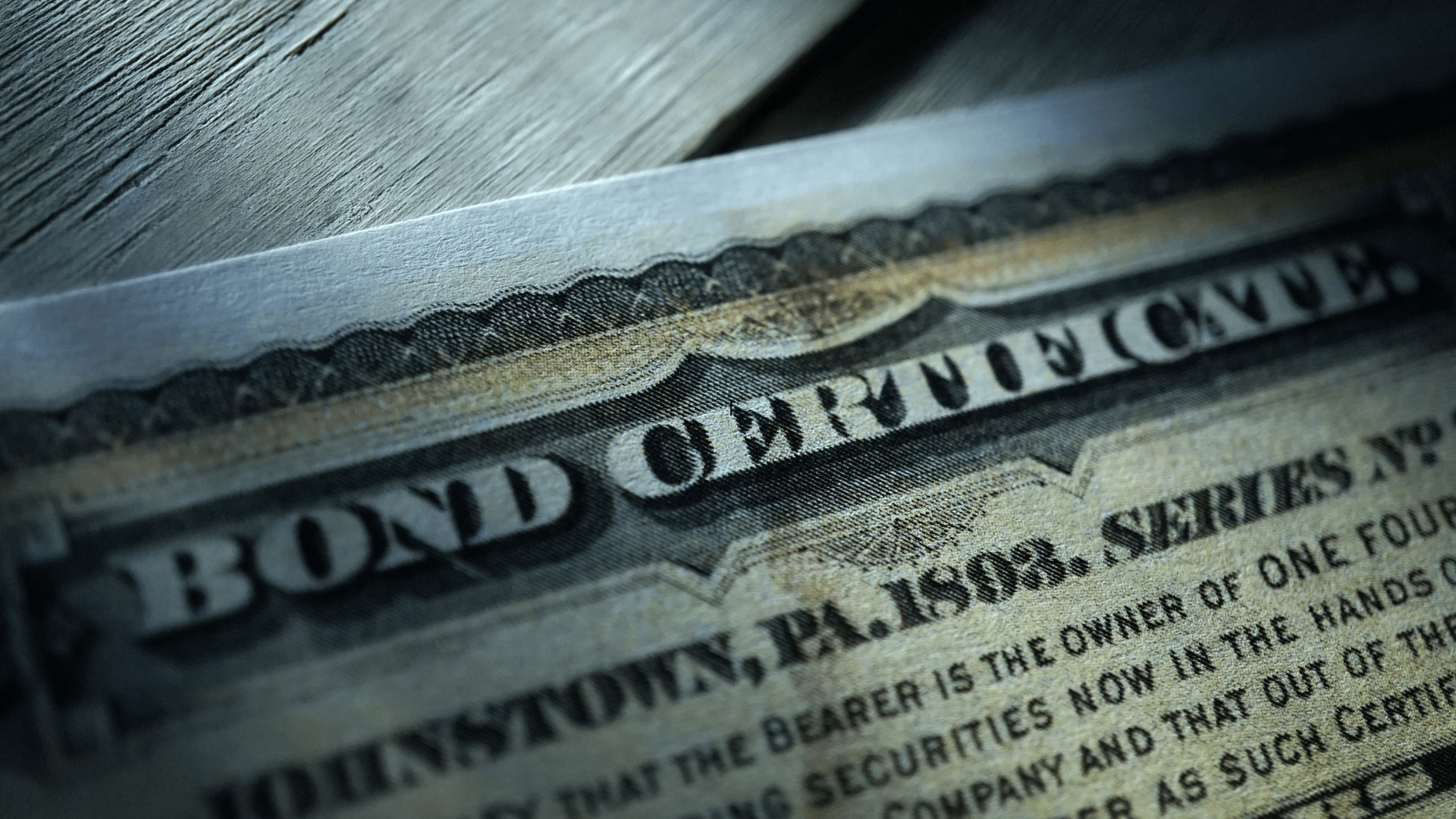

7. Bonds as a Foundation of Stability

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Unlike stocks, which represent ownership in a company and can be subject to significant price volatility, bonds offer a more stable source of income and capital preservation.

The stability provided by bonds can act as a counterbalance to the inherent volatility of stocks. During periods of market downturns, bonds often exhibit less price fluctuation, acting as a cushion for the overall portfolio. This dynamic helps investors navigate turbulent market conditions with more confidence, knowing that a portion of their portfolio is not as susceptible to drastic valuation swings.

8. Income Generation Through Bond Yields

One of the key advantages of including bonds in a diversified portfolio is the potential for consistent income generation. Bonds pay regular interest, commonly known as yields, which can provide a steady cash flow to investors. This income can be particularly attractive, especially for those in or nearing retirement who rely on their investments to cover living expenses.

Different types of bonds offer various risk exposure and varying yields, with government bonds generally considered safer but offering lower yields compared to corporate bonds, which may carry slightly higher risk but also offer higher potential returns. By strategically incorporating bonds with different risk profiles, investors can tailor their portfolios to meet specific income and risk tolerance objectives.

9. Risk Management and Capital Preservation

In addition to providing stability and income, bonds play a vital role in risk management and capital preservation. In times of economic uncertainty or market downturns, investors often flock to safer assets, including high-quality bonds. This flight to safety can result in capital appreciation for bond investments, offsetting losses experienced in other parts of the portfolio.

Moreover, bonds with shorter maturities are less susceptible to both interest rates rise and rate fluctuations, making them attractive in environments where interest rates are expected to rise. By carefully selecting bonds with varying maturities and credit qualities, investors can construct a well-diversified bond portfolio that adapts to different market conditions.

10. Correlation Benefits of Bonds and Stocks

Correlation measures the degree to which two assets move in relation to each other. A correlation of +1 indicates a perfect positive relationship, while a correlation of -1 signifies a perfect negative relationship. Stocks and bonds typically exhibit a negative or low positive correlation, meaning they often move in opposite directions or have minimal correlation.

This negative correlation is a key driver of diversification benefits. When stocks face a downturn, bonds may experience a price increase due to increased demand for safer assets. This inverse relationship helps to eliminate risk and reduce the overall volatility of the portfolio, offering a smoother investment experience for the investor.

Vista Land's Strategic Move as an Ideal Example

Examining real-world examples can provide valuable insights into the practical application of diversification strategies. Recently, Vista Land and Lifescapes, a prominent real estate developer, made a strategic move to manage risk by diversifying its funding sources through the issuance of corporate bonds. This move exemplifies how companies can leverage the stability and income-generation potential of bonds to strengthen their financial positions.

By issuing bonds, Vista Land not only accessed an alternative source of capital but also diversified its funding structure. This further diversification strategy reduces the company's reliance on traditional financing methods, such as bank loans or equity offerings. The bonds issued by Vista Land provide investors with a fixed-income instrument, creating a win-win scenario where the company secures capital for its projects while offering investors a predictable income stream.

The inclusion of bonds in investment portfolios is a fundamental strategy for achieving diversification. Bonds provide stability, consistent income, and effective risk management, making them a valuable asset class for investors of all risk profiles. The recent strategic move by Vista Land serves as a real-world example of how companies can strategically leverage bonds to enhance their financial positions, further highlighting the relevance and impact of bonds in the realm of investment diversification. As financial markets continue to evolve, the role of bonds in diversification strategies remains as relevant as ever, offering a reliable foundation for building and preserving wealth over the long term.

.png)