According to the recent report published by the Philippine Statistics Authority (PSA) on June 6, 2023, the headline inflation rate of the country experienced a decline. In May 2023, the rate dropped to 6.1 percent from 6.6 percent in April 2023. This development contributed to an average inflation rate of 7.9 percent between January and April. Due to this downward trend, the domestic inflation rate is significantly closer to the ideal target range of 2.0 to 4.0 percent.

Inflation drop in food, electricity, transport, and other daily necessities

In the same month, the inflation rate for food decreased to 8 percent compared to the previous rate of 9 percent in March. This decline was attributed to a slowdown in the inflation rates of heavily weighted food items and non-alcoholic beverages, including vegetables, sugar, meat, fish, and other dairy products. On the other hand, the non-food inflation rate also experienced a slowdown, dropping to 5.5 percent from the previous rate of 6.3 percent. This deceleration was primarily driven by slower inflation in electricity costs and a continued decrease in prices related to private transport, such as diesel, gasoline, and liquefied petroleum gas.

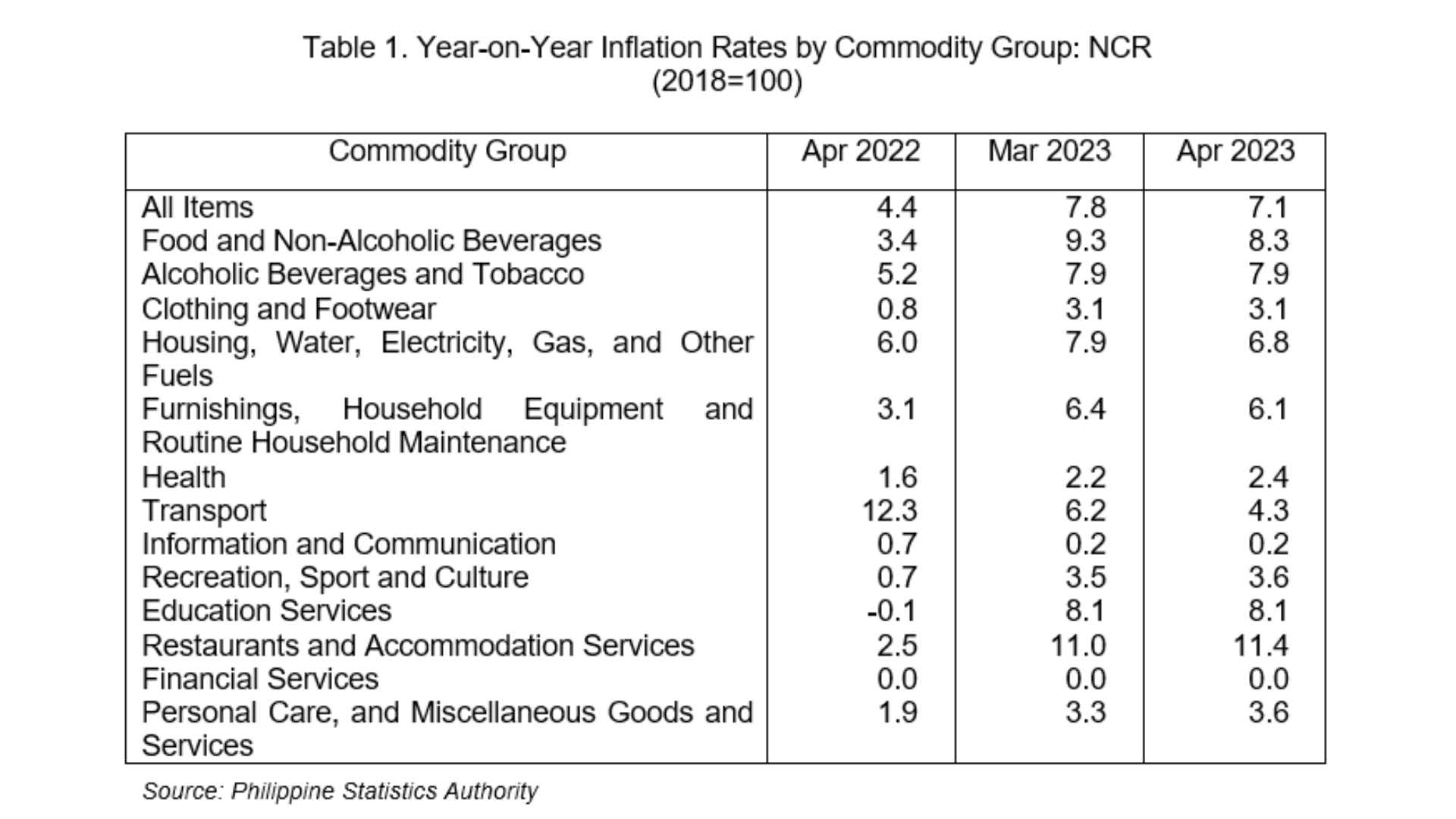

In the National Capital Region (NCR), a significant decline in inflation was experienced, dropping from 4.3 percent in April 2023 to 1.1 percent in May 2023, representing a decrease of 3.2 percentage points. This decline in the previous month accounted for approximately 35.4 percent of the overall downward trend in inflation. Following closely was the index for restaurants and accommodation services, which saw a decrease in inflation from 11.4 percent to 9.5 percent, a decline of 1.9 percentage points. This category contributed around 33.4 percent to the overall slowdown in inflation. The food and non-alcoholic beverage index in the region had an inflation rate of 7.6 percent and contributed 28.2 percent to the downward trend in inflation.

The PSA also reports that the Consumer Price Index (CPI), defined as the measure of the average change over time in the prices paid by urban consumers for a market basket of goods and services, for NCR in May 2023 remained steady at 118.1 percent, unchanged from the previous month's data. With these satisfactory figures, the National Economic and Development Authority (NEDA) is confident that this downward trend will be consistent in the months to come with the continuous efforts of the government.

Economic Expansion in the Philippines

Economic growth refers to an increase in the production of goods and services in an economy over a specific period of time. It is often measured by indicators such as Gross Domestic Product (GDP), which quantifies the total value of all goods and services produced within a country.

The economy undergoes fluctuations in activity referred to as the "business cycle," which comprises four phases. These phases are expansion, peak, contraction, and trough. As of this writing, the Philippines is in the first phase of expansion, which is characterized by an upward trajectory in employment, income, industrial production, and sales, resulting in a rise in real GDP.

Economic growth can be further fostered through the regulation of the headline inflation rate as well as other economic markers in the country, as it can induce price stability, increased investment and borrowing, real wage gains, business and consumer confidence, and even international competitiveness.

Lower inflation rate and economic growth

When inflation slows down, it can have several implications for the economy and various stakeholders. Slower inflation leads to a lower rate of price increases, resulting in increased purchasing power for consumers and businesses. With prices rising at a slower pace, people can afford more goods and services with their existing income, which stimulates consumption and investment. Prices for housing, water, electricity, gas, and other household essentials decrease, easing the burden on people.

Inflation rate declines are also followed by central banks responding by lowering interest rates. This move stimulates borrowing and investment by reducing the cost of borrowing. Lower interest rates encourage businesses to invest in new projects and individuals to make big-ticket purchases like homes. Moreover, decreased interest rates incentivize spending and contribute to overall economic growth. In the Philippines, the Banko Sentral ng Pilipinas' (BSP) Monetary Board determines the interest rates corresponding to the trend exhibited by the local inflation rate.

Slowing inflation can also indicate a decrease in the rate at which wages and production costs are rising. This reduction in cost pressures benefits businesses, allowing them to maintain or improve profit margins without passing significant price increases on to consumers. It can also support job creation, reduce the risk of wage-price spirals, and improve overall economic stability.

Additionally, slower inflation can lead to real wage gains for workers. When inflation slows down and nominal wages remain relatively stable, workers experience an increase in their purchasing power. This improvement in real wages enhances living standards and can potentially result in higher levels of consumer spending.

However, it is essential to be cautious of the potential for deflationary pressures if slowing inflation persists and turns into deflation—a sustained decrease in the general price level. Deflation can discourage consumption as consumers delay purchases, anticipating further price declines. It can also increase the burden of debt and hinder economic growth as businesses and individuals face declining revenues and income.

It is crucial to recognize that the implications of slowing inflation can vary based on specific economic conditions, the underlying causes of the slowdown, and the responses of central banks and governments. Different sectors of the economy and individuals may be impacted differently by changing inflation dynamics. Monitoring and understanding these implications is essential for policymakers, businesses, and individuals to navigate and adapt to the evolving economic landscape.

Projected inflation rate in the remainder of 2023

With the satisfactory figures reported in May, Governor Felipe Medalla of the Bangko Sentral ng Pilipinas is extremely confident that inflation will drop below 4% by September or October. Meanwhile, the economic team of President Ferdinand Marcos Jr. has revised the government's inflation forecast for the entirety of 2023, raising it to a range of 5% to 7% instead of the ideal 2% to 4%. This adjustment reflects the continued impact of elevated costs in areas such as food, energy, and transportation.

Nevertheless, NEDA chief Arsenio Balisacan asserts that the inflation rate will be in a consistent downward trend for consecutive months. The consistent drop in the inflation rate for the past three months is a strong indication that the government's holistic approach to combating inflationary pressures is producing favorable outcomes, and it is expected to continue doing so for the rest of the year.

"The government continues to implement calibrated and swift measures to arrest inflation and its impact, including addressing supply issues, especially in food products, providing targeted cash transfers and social protection programs to the most vulnerable sectors of society, and ensuring access to affordable and reliable energy sources," Balisacan said.

Finance Secretary Benjamin Diokno also states that the current figures project a high probability that we will reach the midpoint of the target range of 2.0 to 4.0 percent by next year.

All things considered, economic growth in the Philippines is anticipated to moderate in the current year, following a strong performance in 2022 that exceeded expectations. Increased domestic demand and the recovery of the services sector, with tourism playing a significant role, will continue to drive the economy's healthy growth.

For more information on Vista Residences, email [email protected], follow @VistaResidencesOfficial on Facebook, Twitter, Instagram, and YouTube, or call the Marketing Office at 0999 886 4262 / 0917 582 5167.

_11zon.jpg)

_11zon-1689132208.jpg)

.png)