The process for obtaining a digitized Tax Identification Number (TIN) ID in the Philippines typically involves online application through the Bureau of Internal Revenue (BIR) website.

Please note that procedures may evolve, so it's recommended to check the official BIR website or contact your local BIR office for the latest information. Here's a general step-by-step guide based on the process as of my last update:

How To Apply For Digitized Tin ID

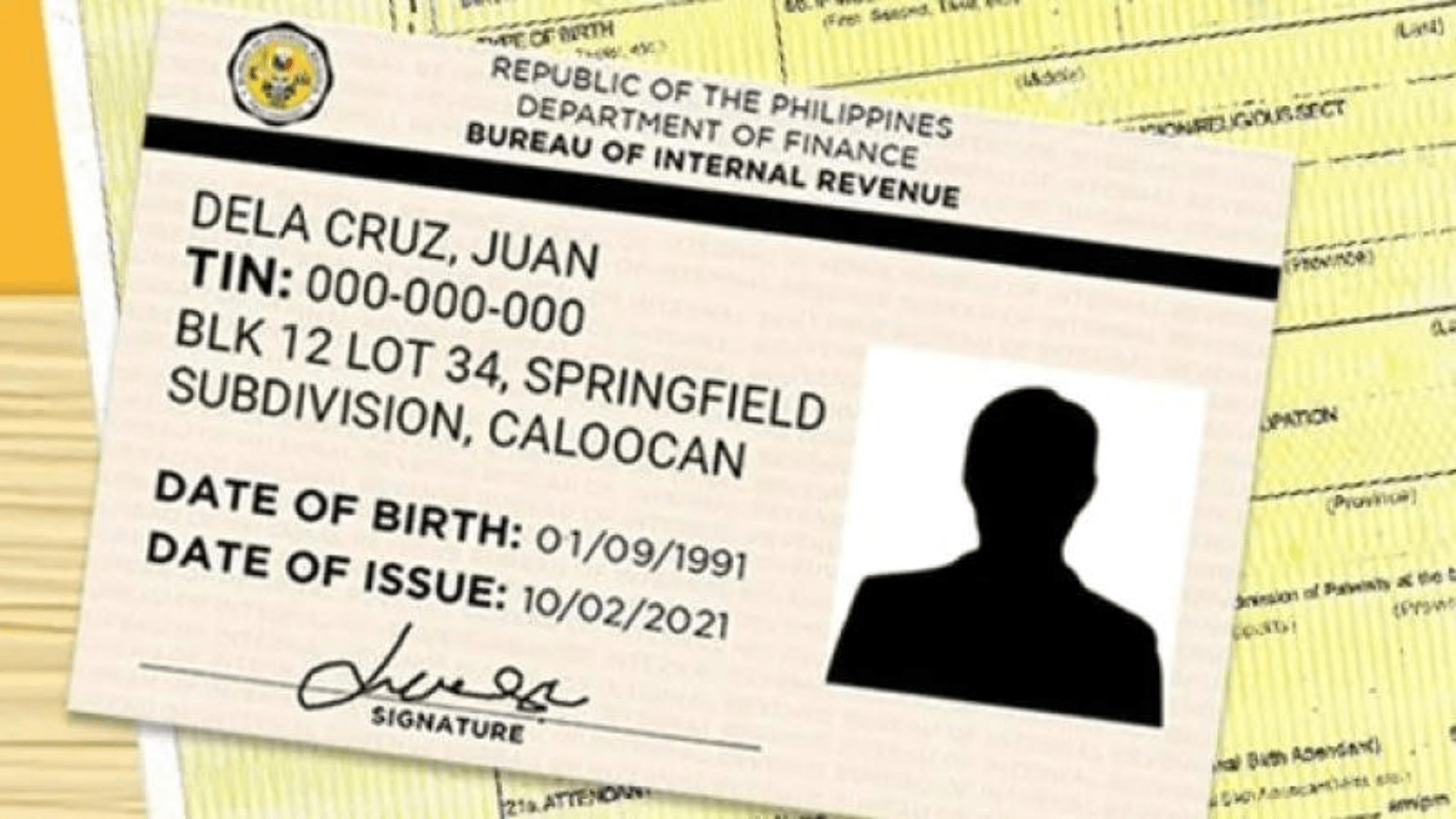

The TIN is a unique identification number assigned to individuals and entities for tax purposes. The Digital TIN ID serves as an electronic proof of one's TIN and is accessible through online platforms provided by various local government units and agencies and by the BIR. Below are the step by step guide to obtain your digitalized TIN ID.

1. Visit the BIR Website:

Access the official BIR website at www.bir.gov.ph using a computer or mobile device with internet connectivity.

2. Navigate to the eTIN System:

Look for the eTIN system on the BIR website. This is the bureau of internal revenue re's online registration platform for TIN-related services.

3. Create an Account:

If you don't have an existing account, you may need to create one on the eTIN system. This typically involves providing your email address, creating a password, and filling out a registration form.

4. Log In to the eTIN System:

Log in to the eTIN system using your registered email address and password.

5. Fill Out the TIN Application Form:

Complete the online TIN application form with accurate and up-to-date information. This may include personal details, contact information, and other relevant data.

6. Upload Required Documents:

Prepare scanned copies or clear photos of the required documents. Commonly, these include a valid government-issued ID, birth certificate, and proof of address. Check the specific requirements outlined in the bureau's online registration application form.

7. Submit the Application:

Once you've filled out the form and attached the necessary documents, submit your application through the eTIN system. Take note of any reference or tracking number provided.

8. Wait for Verification:

The BIR will review and verify the information you provided. This process may take some time, so be patient. You can check the status of your application on the eTIN system using the reference or tracking number.

9. Receive TIN Confirmation:

Upon successful verification, you will receive a TIN confirmation or notification. This may include your TIN and instructions on how to proceed.

10. Download or Print the Digitized TIN ID:

Access the BIR eServices portal or follow the instructions provided in the confirmation to download or print your digitized TIN ID. This digital ID serves as an official document verifying your taxpayer identification number.

11. Keep Your TIN Secure:

Once you have your digitized TIN ID, it's crucial to keep it secure. Use it responsibly for official transactions, tax filing, and other legal purposes.

Please note that procedures may change, and it's essential to verify the latest requirements and steps on the official BIR website or through direct communication with the BIR. The digitized TIN ID provides a convenient alternative and efficient way to obtain and manage your Tax Identification Number in the Philippines.

Taxpayers with TIN

For taxpayers with Tax Identification Numbers (TINs) in the Philippines, possessing a TIN represents a fundamental aspect of their engagement with the country's taxation system. A TIN is a unique identification number assigned by the Bureau of Internal Revenue (BIR) to individuals and entities for tax-related purposes. Holding a TIN is essential for a variety of financial transactions, including employment, business registration, and tax filing.

With a TIN, taxpayers gain access to various government agencies, benefits and responsibilities. It serves as a means of tracking taxable transactions, ensuring compliance with tax regulations. Individuals with TINs are required to include this identification number in various financial documents, such as income tax returns, business permits, and other relevant forms. Moreover, having a TIN is a prerequisite for opening bank accounts, participating in future transactions, government auctions, and engaging in real estate transactions.

For taxpayers, the TIN is not merely a numerical identifier; it represents a commitment to fulfilling civic duties and contributing to the nation's revenue system. Taxpayers should keep their TINs secure and readily available for official transactions, enabling smooth interactions with local government units and government agencies,, financial institutions, and employers. As technology advances, the introduction of digital TIN IDs provides a convenient and accessible way for taxpayers to manage and present their TIN information electronically. Regular updates from the BIR and adherence to tax regulations ensure that individuals and entities with TINs contribute responsibly to the nation's economic development.

Frequently Asked Questions (FAQs) about Digitized TIN ID

1. What is a Digitized TIN ID, and how is it different from the physical card?

- A digitized TIN ID is an electronic version of the Tax Identification Number (TIN) card issued by the Bureau of Internal Revenue (BIR). Unlike the physical card, the digitized version is accessible online, allowing individuals to download and print it as needed.

2. How do I apply for a Digitized TIN ID?

- To apply for a digitized TIN ID, visit the official BIR website, access the eTIN system, and follow the online application process. Fill out the necessary forms, upload required documents, and submit your application electronically.

3. What documents are required for the Digitized TIN ID application?

- Commonly required documents include a valid government-issued ID, birth certificate, and proof of address. However, specific requirements may vary, so it's advisable to check the BIR website for the most up-to-date information.

4. Can I track the status of my Digitized TIN ID application?

- Yes, applicants can track the status of their application through the BIR eTIN system. The system typically provides a reference or tracking number upon submission, allowing individuals to monitor the progress of their application.

5. How long does it take to receive the Digitized TIN ID after application?

- The processing time for a digitized TIN ID can vary. After submitting the application, there is a verification period during which the BIR reviews the provided information. Applicants can check the status regularly on the eTIN system.

6. Can I use the Digitized TIN ID for official transactions?

- Yes, the digitized TIN ID is a valid and recognized document for official transactions. It serves as proof of your Tax Identification Number and is accepted for various purposes, including employment, financial transactions, and other official dealings.

7. Can I download and print my Digitized TIN ID multiple times?

- In most cases, individuals can download and print their digitized TIN ID multiple times. It's advisable to keep electronic and physical copies for easy access during official transactions.

8. What should I do if there is an issue with my Digitized TIN ID application?

- If you encounter issues or have questions about your application, it is recommended to contact the BIR directly or visit the nearest BIR office for assistance. They can provide guidance on addressing specific concerns.

9. Is there a fee for obtaining a Digitized TIN ID?

- As of my last knowledge update in January 2022, the digitized TIN ID application is generally free. However, it's essential to check for any updates or changes on the official BIR website, as fees and policies may be subject to change.

10. Can I use my Digitized TIN ID for online sellers and transactions?

- Yes, the digitized TIN ID can be used for online transactions and verification purposes by online sellers. Its digital format allows for easy sharing and presentation in electronic formats when required for various online processes.