Commuting plays an essential role in your decision whether or not to move closer to your workplace. If you are considering relocating near your office, you might be asking yourself whether to rent or buy a condo nearby that fits your lifestyle.

However, choosing a move-in-ready unit and deciding whether to rent it or buy it has its own set of considerations.

If you are thinking of buying a property, you will be forced to stay in one place for a few years and the amount of money placed in your deposit will be illiquid capital. On the other hand, if you are planning on leasing a unit, you will keep on paying and spending money on someone else’s property, instead of yours.

Here’s a quick guide to help you make an informed decision on whether to rent or buy your own condo unit in Manila.

1. Your Budget vs. Upfront Costs

Your budget can definitely affect your decision on renting or buying a property. Buying comes with upfront expenses like down payment, bank and title fees, as well as miscellaneous fees, which add up quickly.

Renting, on the other hand, requires paying the first and last month’s rent and a security deposit, depending on the agreement with the owner.

2. Your Job

How is your job? How long have you been staying with the company?

If you think you are secure with your job, the company is stable and you see a progress in your career, then it might be good for you to invest in a nearby condo unit. Living in a condo near your workplace will give you the comfort and convenience that you deserve after a long day’s work.

Meanwhile, if you are into a job that requires travelling or has opportunities to be assigned abroad or be relocated, you might want to keep your options open and rent instead of buying a condo.

One of the benefits of renting is that it is easy to move in and out without worrying about selling the property or buying somewhere else.

3. Short-term vs. Long-term goal

If you are planning long-term and thinking of buying a condo, the best approach is to look for inner-city condo properties with positive growth potential. Look for areas that are likely to be redeveloped or those with infrastructure improvements and business opportunities that will likely contribute to the increase in property value.

However, if you are looking at addressing a short-term need like the necessity of living near your workplace, then you might consider renting a unit.

Why Invest a Condo in Manila?

As the capital city of the Philippines, Vista Residences makes sure that it provides a quality condominium property for everyone to ensure life ease of access to conveniences. These condos for sale in Metro Manila and some are for rent, a perfect place not just as home for individuals but for businesses as well, with available property type or units of studio, 1-bedroom, and 2-bedrooms.

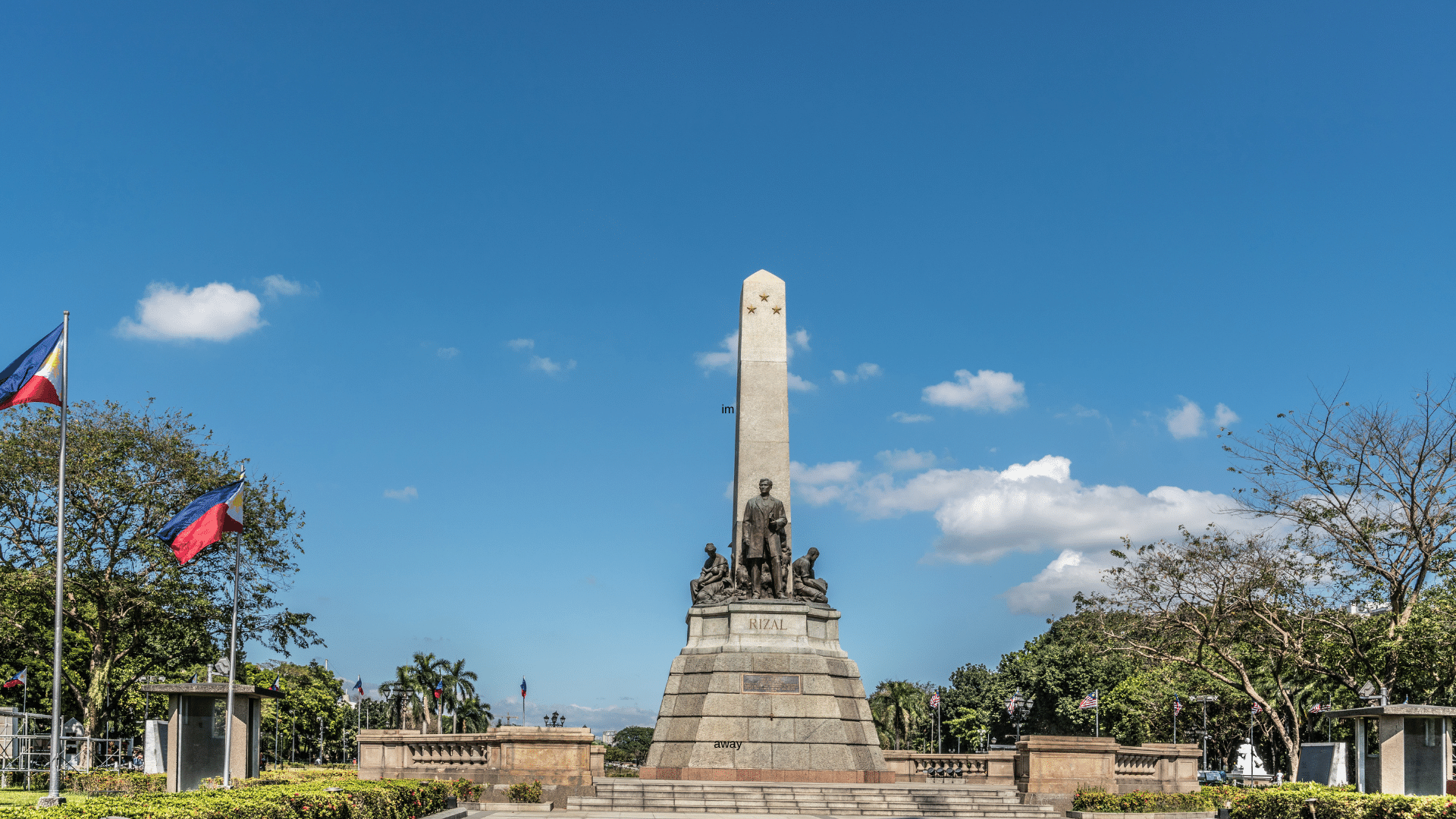

Manila City is densely populated and rich in historical sites, but condominiums are scarce. In Manila, you can find any type of condo you can imagine, ranging in size and price. Whether you're looking for a small studio unit or a two-bedroom unit, you'll most likely find it here.

While Manila properties are currently less expensive than properties in city centers such as Makati City and Bonifacio Global City in Taguig, prices are rapidly rising, making for an excellent investment.

There are a number of condominiums in Manila City that you can buy or lease. Aside from providing convenience, comfort, security, and accessibility, condominium living can also give you access to various amenities like a swimming pool, fitness center, lounge, and function hall.

The main benefit of leasing a condo property is flexibility especially when your need for space and location might change in the next few years. However, if the thought of paying off somebody else’s mortgage instead of your own makes you feel anxious, you might need to look for a condo unit that you can afford to pay your loan on.

Buying a condo property, whether new or pre-owned, will give you a good opportunity to grow your hard-earned money as its value increases over time. You can also enjoy the freedom to upgrade the look and add value to the property over the years so you can sell it for a profit and move when circumstances change.

Whether you are focused on achieving more in terms of your career or want to get the best value out of your money, you have to consider your condo property options carefully as well as your financial security, job prospects, personal preferences, and priorities.

If you are looking for a new home and condo, Vista Residences is the best option for you! At Vista Residences, unit owners can take advantage of the property’s centrality. The properties of Vista Residences are strategically located near the country’s premium universities and CBDs, making them an attractive investment for both local and foreign investors.

Vista Residences is the condominium arm of the country’s largest homebuilder, Vista Land & Lifescapes, Inc. that offers ready for occupancy and pre-selling condominium projects in Metro Manila, Makati, Mandaluyong, Quezon City, Ortigas, Baguio, Cebu, and CDO that are strategically located within key districts and major cities such as Eastwood City and Century City, in close proximity to premium universities such as De La Salle University and Ateneo de Manila University, transit-oriented locations, and developed business districts.

In line with Vista Residences’ thrust to offer convenience among its residents, it also features an AllDay Convenience Store and Coffee Project in all its projects.

Vista Residences is part of Vista Land’s roster of condominium brands that cater to millennials and young professionals. The other vertical brands include Camella Manors, COHO, and Crown Asia.

For more information on Vista Residences, email [email protected], follow @VistaResidencesOfficial on Facebook, Twitter, Instagram, and YouTube, or call the Marketing Office at 0999 886 4262 / 0917 582 5167.