Credit cards have become an integral part of our financial landscape, offering convenience and a myriad of benefits. However, alongside the perks, some particular credit card holders often encounter the enigma of credit card annual fees. Understanding these fees is crucial for making informed financial decisions. In this guide, we'll delve into the intricacies of credit card annual fees, exploring what they are, why they exist, and how to navigate them wisely.

What are Credit Card Annual Fees?

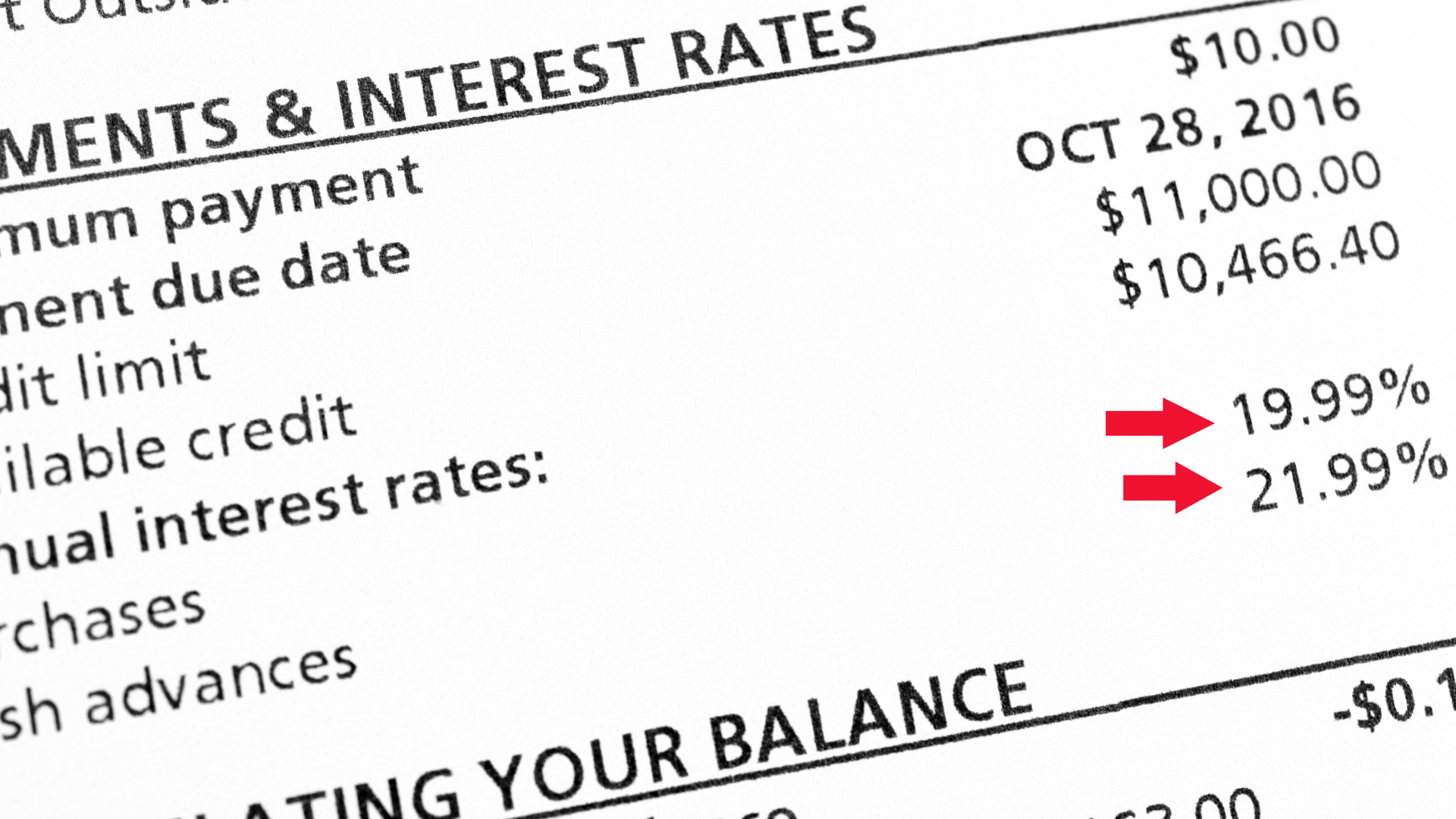

Credit card annual fees (the one you can see in statement credit every billing, mostly by the end of the year) are charges that are part of credit card issuers' policy. Its an existent deal for the privilege of holding and using the card and are typically billed once a year. Though some cards may offer alternatives such as monthly, quarterly payments, or waived at all, annual fees can vary widely, ranging from zero to several hundred dollars, depending on the card's prestige.

On other note: beyond such fees, it's also important to take note of other credit card payments that you might not see at first. Monthly minimum payments, typically a percentage of the outstanding balance, are crucial to maintaining a positive credit history.

Neglecting these payments can lead to late fees, increased interest charges, and a negative impact on your credit score. It's advisable to avoid unpaid minimum amount or paying more than the minimum amount whenever possible to reduce the overall interest paid over time.

Why Do Credit Card Issuers Charge Annual Fees?

Credit card companies levy annual fees to offset the costs associated with providing various benefits and services to cardholders. These costs can include rewards programs, travel perks, insurance coverage, and other features that enhance the cardholder experience. Premium or exclusive cards often have higher annual fees, reflecting the enhanced benefits they offer.

Rewards Programs and Credit Card Fees

Many credit cards entice customers with lucrative rewards programs, such as cash back, travel points, or other incentives. The costs associated with managing and funding these programs are often covered by annual fees.

Cardholder Services and the Role of Credit Card Annual Fees

Premium cards often provide concierge services, travel insurance, extended warranties, and other perks. The annual fee helps cover the expenses incurred in delivering and maintaining these services.

Risk Mitigation and Credit Card Annual Fees

Credit card companies also factor in the potential risk and default rates when determining annual fees. Charging an annual fee can help mitigate losses and offset the risks associated with providing credit to a diverse customer base.

Types of Credit Cards and Their Annual Fees

Standard Cards and No Fee Credit Cards

Basic or standard credit cards typically come with little to no annual fees. These cards are designed for everyday use and are suitable for individuals who may not need or want additional perks.

Rewards Cards and the Trade-off of Credit Card's Annual Fee

Cards with rewards programs, such as cash back or travel rewards, often come with moderate annual fees. The potential for earning rewards may outweigh the cost for those who actively use and maximize the benefits.

Premium or Exclusive Cards and High Credit Card Annual Fees

High-end or exclusive credit cards, often associated with luxury brands or prestigious financial institutions, tend to have substantial annual fees. These cards offer elite perks, personalized services, and exclusive access to events, making them attractive to a specific demographic.

How to Evaluate Credit Card Annual Fees?

- Assess Your Usage and the Impact of Credit Card Annual Fees: Before choosing a credit card with an annual fee, assess your spending habits and financial needs. If you don't use the card frequently or won't benefit from the associated perks, a no-annual-fee credit card might be more suitable.

- Calculate Potential Rewards and Consider Credit Card Annual Fees: For cards with annual fees, calculate the potential rewards and benefits against the cost of the fee. If the rewards outweigh the fee and align with your lifestyle, the credit card annual fee may be a valuable investment.

- Consider Sign-Up Bonuses and Their Interaction with Credit Card Annual Fees: Some credit cards offer lucrative sign-up bonuses that can offset the annual fee in the first year. Evaluate these bonuses to determine if they provide immediate value.

- Review Additional Benefits and Their Relation to Credit Card Annual Fees: Take a close look at the additional benefits offered by the card, such as travel insurance, airport lounge access, or concierge services. If these align with your needs and preferences, the annual fee may be justified.

How and When Are Annual Fees Charged on Credit Cards?

- Understanding the Timing of Credit Card Annual Fees: It's essential to be aware of when credit card annual fees are charged. While some cards charge the fee upfront, others may offer a grace period or provide options for installment payments.

- Negotiating Credit Card Annual Fees: If you find yourself with a card that charges an annual fee and you're not fully benefiting from it, consider negotiating with the credit card issuer. In some cases, they may be willing to adjust or waive the fee, especially if you have a strong credit history and a positive relationship with the company.

- Considering No Annual Fee Credit Cards as Alternatives: If the prospect of an annual fee doesn't align with your financial goals, explore credit cards with no annual fees. Many reputable cards offer competitive rewards and perks without the extra cost.

- Downgrading or Canceling Credit Cards with Annual Fees: If you currently hold a card with an annual fee that no longer aligns with your financial goals, consider downgrading to a card with a lower fee or canceling it altogether. Be mindful of the potential impact on your credit score and overall credit profile.

A Cautionary Note on Neglecting Credit card Annual Fee

Missing or neglecting credit card annual fees can have severe consequences. These may include:

- Late Fees: Credit card issuers typically impose late fees for missed payments. These fees can add up quickly and contribute to financial strain.

- Interest Charges: Unpaid annual fees may accrue interest, leading to additional financial burdens. It's crucial to address these charges promptly to avoid compounding debt.

- Negative Impact on Credit Score: Missed payments, including annual fees, can negatively impact your credit score. A lower credit score may affect your ability to secure favorable interest rates on loans and credit in the future.

- Loss of Card Benefits: Non-payment of annual fees may result in the suspension or cancellation of the credit card. This, in turn, means the loss of associated benefits, rewards, and perks.

Navigating the world of credit card annual fees involves careful consideration of your financial needs, spending habits, and the potential benefits offered by the card. Whether you opt for a card with no annual fees or choose a premium card with associated costs, understanding the nuances of credit card annual fees empowers you to make informed decisions that align with your financial goals.

.png)