The personal finance landscape in the Philippines is constantly evolving. Now, innovative lending options are available to cater to diverse financial needs.

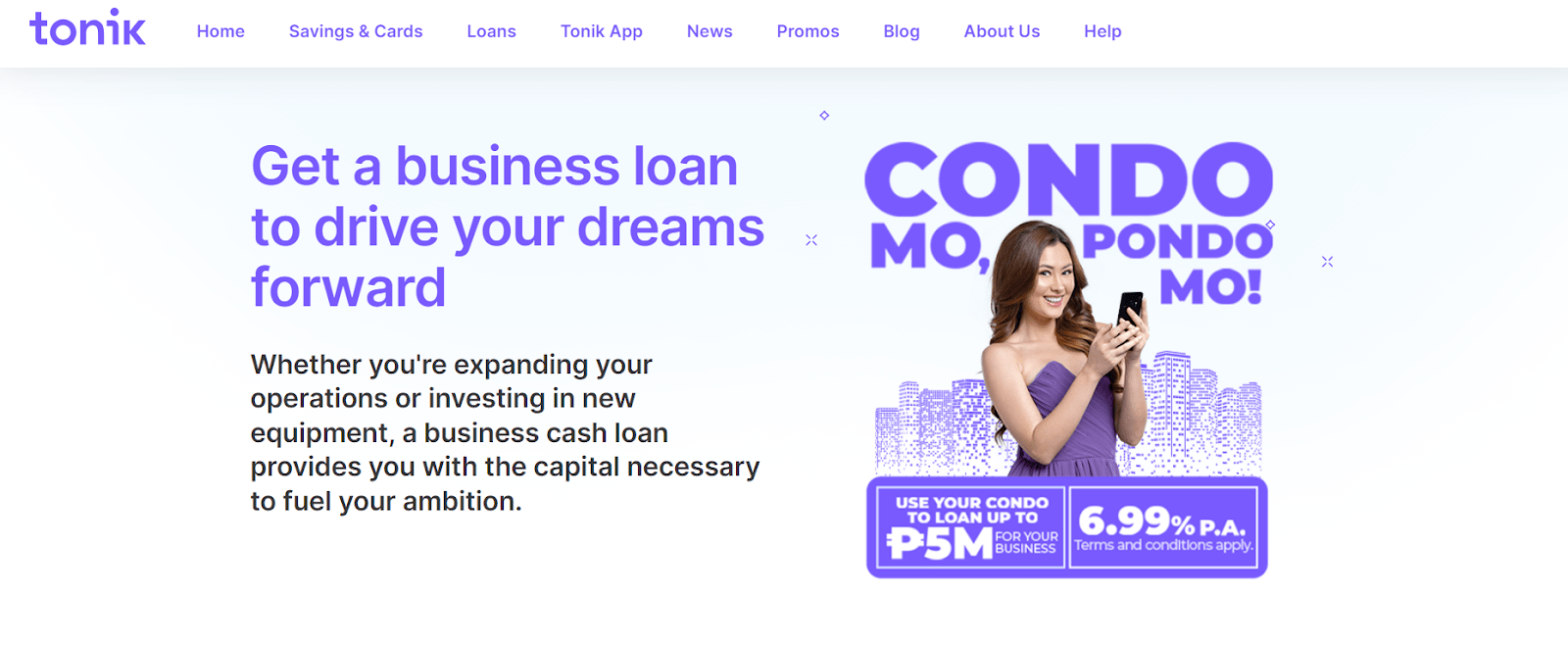

Among various alternative solutions, one intriguing option has gained attention of many individuals: using your condo title to secure online personal or business loans that could potentially reach up to P5 million.

Whether you're a homeowner seeking additional funds for a major expense or a business owner looking to expand your operations, this unique loan offers you an opportunity to leverage the value of your condominium.

By exploring this option, you can unlock the power of your property and discover a new way to have access to readily available funds.

How Do Condo Titles as Collateral For Loans Work?

When it comes to using condo titles as collateral for loans, the process generally involves leveraging the value of your condominium property to secure a loan. After all, your condo title represents your ownership rights to the said property.

Lenders consider the market value of your condo and its location when determining the loan amount you can qualify for.

By offering your condo title as collateral, you provide the lender with a form of security in case of default. This arrangement allows borrowers to access larger loan amounts compared to unsecured personal loans, as the value of the property can mitigate the lender's risk.

When you use your condo title to apply for the Tonik Big Loan, you can get P250,000 to P5 million, and an interest rate of 6.99% p.a. You may also select a 12 to 60 months installment. Plus, you don’t need a credit card or credit history to apply for this loan.

Related: A Beginner’s Guide to Buying a Condo in the Philippines

What Are the Benefits Of Leveraging Your Condo Title To Secure A Loans In The Philippines?

Using your condo title to secure a loan in the Philippines offers several benefits. We’ve listed some below.

Access to Higher Loan Amounts

By using your condo title as collateral, you can secure larger loan amounts compared to unsecured loans. This is because the value of your property provides assurance to the lender, therefore allowing them to extend a more substantial credit line to you.

Competitive Interest Rates

Condo title loans often come with lower interest rates compared to other types of unsecured loans. This is because the collateral mitigates the lender's risk, making it a more secure borrowing option.

When you have a lower interest rate for your loan, it means you can reduce the overall borrowing costs and make your monthly repayments more manageable.

Continued Property Ownership and Use

This is perhaps one of the best benefits of using your condo title for a loan. You can continue to reside or rent out your condominium unit while using the funds obtained through the loan.

How to Get a Big Loan using your Condo

Ready to use your condo title to apply for a loan? Here’s how you can do it.

1. Eligibility

Filipino citizens between 23 to 55 years old can apply for this loan. Applicants must be presently employed and must own a fully-paid condo unit located in Metro Manila. The property also needs to have a clean title.

2. Application Process

First, download the Tonik App and complete the onboarding process. Once complete, select “Loans” and click “Big Loan.” Then, upload the following on your Tonik app:

- Valid ID

- For married borrowers: Your spouse's valid ID and your Marriage Certificate

- Latest 3 months' bank statements and pay slips

- Scanned copy of the Condominium Certificate of Title

- Photos of your condo unit

Pre-application only takes 30 minutes. Tonik’s credit team will get in touch with you to verify your information. Make sure to give your employer and building administrator a head’s up to ensure a smooth verification process.

Next, submit the following at the Tonik hub:

- Original copy of the Condominium Certificate of Title

- Real Estate Tax Clearance

- Condominium Association Dues Certificate

- For widows or widowers: Spouse's Death Certificate

- For annulled borrowers: Final Court Order on Legal Declaration of Nullity of Marriage

Once approved, disbursement only takes 7 days.

What Can Your Big Loans Be Used for?

Loans can give you access to much-needed funds to fulfill various financial needs and goals.

The versatility of online loans allow borrowers to utilize the funds for a wide range of purposes, such as the following:

Debt consolidation

This loan can be used to consolidate multiple debts into a single and more manageable payment. This can greatly help to simplify your finances and potentially reduce your interest rates.

Home Improvements

Loans can also be used to finance home renovation projects, such as remodeling the kitchen, adding an extension, or upgrading the plumbing and electrical systems.

Doing this can improve your living space and increase the value of your property.

Education

Education is becoming more expensive each year.

Whether you are pursuing higher education or professional development courses, loans enable you to invest in your education and future career.

If you need more money to cover the costs of tuition, books, and other educational expenses, this loan can help you.

Medical expenses

The funds can be helpful if you are dealing with unforeseen medical expenses, including surgeries, treatments, and medications. With this loan, you can ensure access to necessary medical care.

Vehicle purchase

Loans can help finance the purchase of a new or used vehicle. Whether buying a car, motorcycle, or any other mode of transportation, loans make it possible to spread the cost over time and ease the burden on one's finances.

Business start-up or expansion

Starting a new business venture or expanding an existing one can be financially draining.

Thankfully, loans can be used to secure capital for equipment, inventory, marketing efforts, and operational expenses, providing entrepreneurs with the necessary resources to fuel their business growth.

Travel and vacations

Loans can also be used to fund memorable travel experiences and vacations. Whether you are exploring new destinations or embarking on a dream getaway, these online personal loans can offer you the means to finance travel-related expenses such as flights, accommodation, and activities.

Wedding expenses

Loans can help cover the costs associated with weddings, including venue rentals, catering, decorations, and attire. A big loan enables couples to plan and celebrate their special day without compromising on their vision.

For more information on Vista Residences, email [email protected], follow @VistaResidencesOfficial on Facebook, Twitter, Instagram, and YouTube, or call the Marketing Office at 0999 886 4262 / 0917 582 5167.

Author Bio:

MJ de Castro is the lead personal finance columnist at Grit PH. MJ started her career as a writer for her local government’s City Information Office. Later on, she became a news anchor on PTV Davao del Norte. Now, she juggles writing professionally, her business centering on women’s menstrual health, and surfing.

.png)