The COVID-19 pandemic has caused a big impact on everyone’s lives. A lot has changed since last year and it is likely that it would not be going back to being completely normal soon. During this time, we are learning life lessons, resetting our priorities, rethinking our careers, and realigning our finances. In times like this, it is understandable for people to be hesitant about jumping into any kind of investment because most of them consider this period as financially challenging. There are even people who, instead of investing their money, have decided to put their money in savings. Surprisingly, there are a few who have recognized the opportunity of purchasing a property and investing in a condominium amidst the pandemic.

Real estate is still considered as one of the most stable investments in the country. Whether it is land, a condominium, or house and lot, real estate properties are considered tangible assets that grow in value over time. Other investments like stocks or bonds are prone to risks and can easily suffer from fluctuations because volatile market trends are inevitable.

The value of real estate property will remain constant. Even if the market conditions swing, its demand will remain stable, which is what happened during this period.

While there are a lot of investment options, it may take years to be able to generate significant income returns. In real estate investment, you can easily gain long-term passive income by renting out your property.

Home is considered a basic human need that is why the demand for properties will continue to rise. If you are keen on exploring real estate business, all you have to do is to buy a property, list it as a rental property, and welcome tenants. By doing so, you would be able to generate a stable amount of money every month.

The pandemic has enabled us to think beyond saving our money and invest and diversify our portfolio to keep us future-proof and mitigate the impact of future financial crises.

In an attempt to counter the ongoing economic recession, markets are shifting and central banks are lowering down interest rates, which is beneficial for investors. Interest rates impact the cost of borrowing money. The lower the interest rates, the cheaper the cost of loans. This easing of borrowing provides more budget flexibility among investors, thus, it becomes easier to get a property loan for that dream home.

During this pandemic, we can also see a lot of property developers selling their projects at discounted prices. Now is the best time to negotiate with them on special discounts and lower prices. Whether you are looking for a pre-selling condo or a ready for occupancy condo unit, you are in the position to choose a property that would give you the best deal that would match your budget and lifestyle needs.

Additionally, property developers are also offering flexible payment options for homebuyers. You might have heard about low reservation fees and down payment that are being offered nowadays to further attract homebuyers.

We can also expect that after the pandemic, the demand for property will certainly outweigh the supply, which means increase in property prices. Investing in a property today will save you from having to pay more for the same property.

This pandemic, take your time to research real estate investment - learn about its pros and cons, compare features and amenities, and check which one will suit your life goals and lifestyle needs.

Real estate properties offer unmatched solutions for financial stability and security. If you are planning to invest in real estate, now is the best time to do so because of the flexible payment options and big discounts that property developers are extending to homebuyers.

According to a study, majority of Filipinos in the United Arab Emirates have cited property as one of their investment choices, same goes with some young OFWs, who think of real estate investment in the Philippines as a difficult item to tick in their checklist. It is quite easy to understand why – it’s a big-ticket purchase that requires careful consideration but can give you higher yield in return.

OFWs still prefer to invest in real estate for the following reasons.

Value of real estate appreciates over time

The value of real estate property increases over time. This is possibly one of the biggest benefits that you will enjoy when you start investing in real estate in the Philippines. While other big-ticket items such as cars and luxury bags can depreciate easily, real estate has a big potential for value appreciation. Demand has something to do with it, especially if you have purchased a property in an area where the supply for homes is low, but the need is high.

You can make money from it

One of the ways to make money from real estate is to wait for the property’s value to appreciate over time and then sell it at a much higher price. But in doing so, you have to take into consideration the number of years you have to wait to be able to sell it at a winning price.

If you’re creative enough or you have the time to be hands-on, you can still monetize your real estate property as soon as you buy it. For one, you can have your condominium leased or rented. If the property is close to tourist spots, you can turn it into an Airbnb space. However, you have to remember that doing so will make you shell out some money for renovation and for adding value to your guests’ arrival.

Another way to turn your property into an income-generating asset is through full-on property conversion, which is very common these days. There are a lot of people who have transformed their corner lot house into a small café or dainty restaurant. While others who have bought a sizable property that accommodate large groups of people, have turned it into a resort or eco-farm. Keep in mind though that this will require some money, so be prepared for it.

It diversifies your investment portfolio

Real estate investment will also help you stabilize your investment portfolio. You may already know that the value of stocks, mutual funds, and similar equities can go up and down based on the prevailing conditions in the market.

To counter the effects of such fluctuations, you need to have a non-liquid investment, like a real estate property. This is because the value of condominiums, houses and lots, and farm estates appreciate over time. In cases where the value of stocks and mutual funds go down at a given time, the worth of your real estate property is likely to remain the same, thus keeping you from losing a great deal of assets or money.

The equity of your property has a lot of uses

Home equity is not just a popular term in the real estate industry. Home equity is the value of your ownership over a real estate property.

Moneymax Philippines has illustrated home equity with the following example: If you bought a house worth PHP 1.5 million and you have made a down payment of PHP 700,000; you automatically have equity of PHP 700,000. As you pay off your mortgage over time, the value of your ownership also increases. And because the value of property appreciates, you may also expect that your equity will also follow that trend.

In addition, your home equity can be used in many ways. You can use it to apply for loans that will help you in funding personal expenses, even the major ones. For example, you can tap into your property equity to renovate your home.

To easily build equity, you must never miss a monthly payment. You may also revamp and improve your home, as such efforts will also help you increase your property’s value.

You can maintain control over your property

When you’re investing, whether in real estate or other assets, you don’t only take into account the money that you will make in the future. You are also considering the potential losses.

In this regard, you may count real estate as a relatively low-risk investment. This is because the property’s value tends to stay the same or increase, especially if the demand for homes and lands increases.

And unlike investing in stocks, you have assurance that real estate can stick with you when times get tough, as it is a tangible asset. This means that you have control over it, and if you’re creative, brave, and willing enough, you can turn it into a money-making asset.

If you are looking to invest in a property, you have to consider a home that will suit your lifestyle.

Once you already have a clear picture of what property suits you, you will then have to study the market. While real estate investment in the Philippines is a good opportunity for business, you need to remember that you are also dealing with competitors. At this point, you will have to research about the area or the location that you are eyeing. Is the prospective property close to transport terminals, schools, parks, hospitals, churches, malls, and banks? Remember that the closer the property is to these amenities, the higher its value. This is because the demand for the said property is possibly high.

In property investing, the golden rule here is that you need to buy within your means, otherwise, you will find it difficult to pay your mortgage eventually. When assessing your budget, you have to have a thorough look on your personal finances – from your monthly income to existing assets and liabilities. When evaluating your budget, it will require you to consider the down payment, real estate broker fees, documentation fees, and other closing costs.

Before you decide on the type of real estate property you will buy, you want to have the assurance that it will be worth it. You won’t be able to know this unless you have lived in the house for some years. But you can research the developer - its reputation, customer feedback, and quality of development. Check the developer’s other real estate projects and take a look at their features and amenities. If you happen to know someone who lives in one of these projects by the said developer, you can ask about their experience and even frustrations.

You may be financing your home through a bank or through government agencies like the Pag-IBIG Fund. Regardless, you will need to secure the necessary documents, which usually include pay slips, tax returns, and employment certificates. However, before you settle for a financing scheme, it’s better to compare different loans first. It is always smarter to pay in cash for bigger discounts but in any case, check all possible options and evaluate.

Vista Residences, the condominium arm of the country’s largest developer, Vista Land & Lifescapes, Inc. offers ready for occupancy and pre selling condominium projects in Manila and Quezon City that are strategically located within inner-city areas, in close proximity to developed business districts and prestigious universities.

Vista Residences has ready for occupancy condo projects in Manila such as Vista Taft, Vista Heights, Vista GL Taft, 878 Espana, and Crown Tower University Belt. It also has pre selling projects in the said area which include Vista Recto, Plumeria Heights, Tennyson Heights, Bradbury Heights, Sky Arts Manila, and Kizuna Heights.

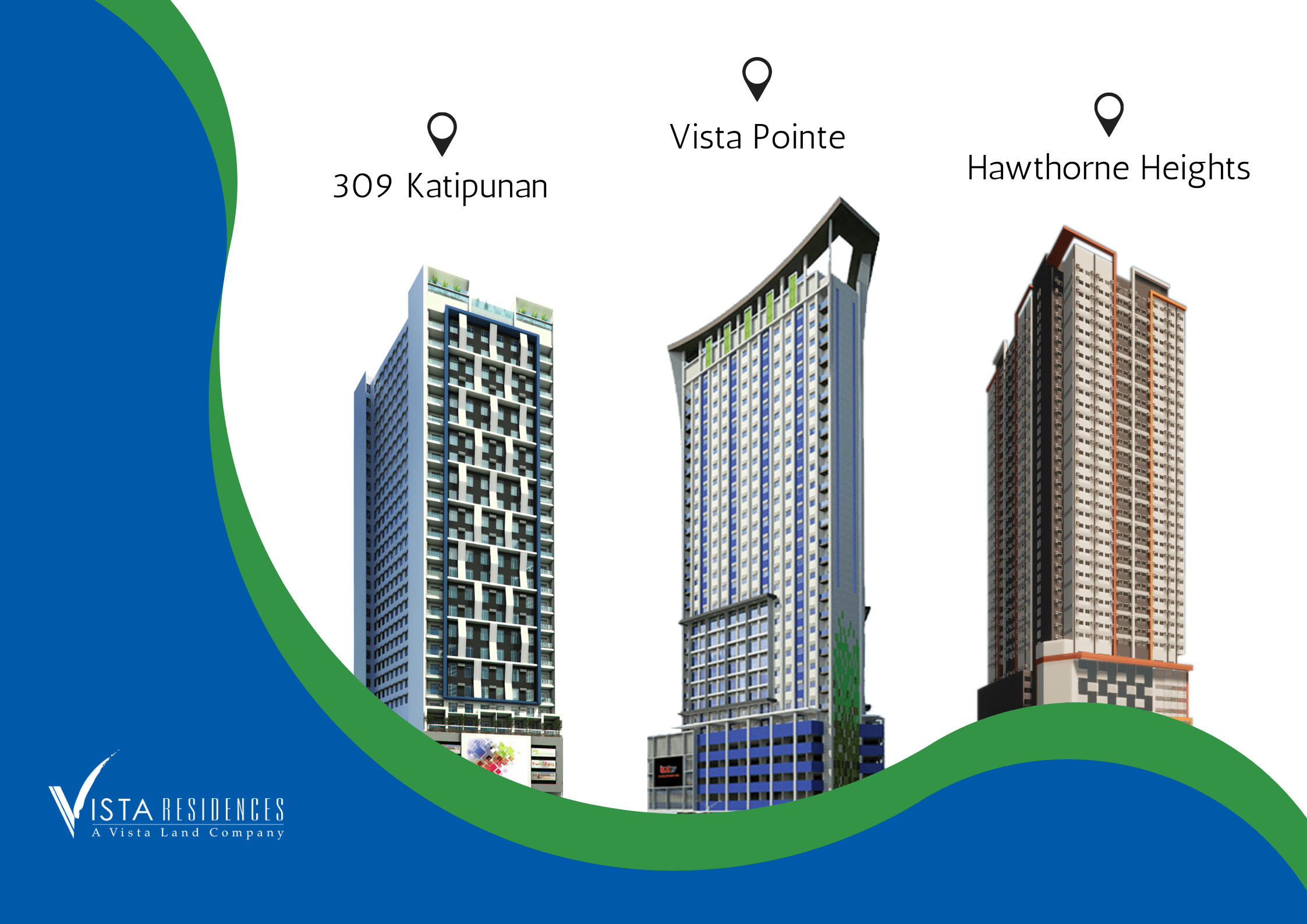

Meanwhile, its ready for occupancy projects in Quezon City include Wil Tower, the Symphony Towers, Pine Crest, and Vista 309 Katipunan. It also has pre selling condo projects in the said city such as Hawthorne Heights and Vista Pointe.

Living in Vista Residences enables you to enjoy convenience, where everything is pretty much within walking distance or a few minutes away from the property; comfort because the project features and amenities are designed to deliver comfort at all times, which makes condo living a worthy investment; security that is 24/7 and CCTV monitoring, which makes the residents safe and secure within the property.

In line with Vista Residences’ thrust to offer convenience among its residents, it also features an AllDay Convenience Store and Coffee Project in all its projects.

For more information on Vista Residences, email at [email protected], follow @VistaResidencesOfficial on Facebook, or call the Marketing Office at 0999 886 4262 / 0917 582 5167.