Making investments is a big choice, particularly for OFWs who wish to have closer ties with the Philippines after dedicating a lifetime to working abroad. Since real estate investing is one of the best options available to Overseas Filipino Workers (OFWs) in the country, it is crucial to understand how to locate the ideal location for your real estate investment, which is why a lot of entrepreneurs, investors, and property owners work hard to secure what's referred to as a prime location.

If you are a first-time real estate investor who is struggling to find the perfect location, keep reading this article. Together with a brief outline of investment opportunities for OFWs, we will be giving you tips when it comes to choosing the prime locations for your first investment.

OFW Investment Opportunities

Investment means allocating funds or capital to a venture in order to eventually earn additional income or profit, making it crucial for OFWs to recognize the significance of investment instead of just spending money on leisure. OFWs should put long-term financial stability ahead of short-term requirements by making wise investing decisions. It is an essential way to lessen the uncertainty after leaving for overseas employment, and you may guarantee a more comfortable future for yourself and your family by making sensible investing decisions and putting your hard-earned money down on the right things. Before proceeding to real estate and choosing the prime location for it, let us give you some of the best investments to consider.

The best investment in the Philippines for OFW

Stock Market

Another way that OFWs could grow their financial assets is through stock market investments. While stocks carry a higher risk and volatility profile, they can offer longer-term investing opportunities that might produce higher returns. When it comes to retirement investing ideas for OFWs, stocks are also more liquid than other options, so you may sell them and get the money you invested back with ease. But before investing in the stock market, investors should still do extensive research or consult with financial experts.

Mutual Funds and Unit Investment Trust Funds

Mutual funds and Unit Investment Trust Funds (UITFs) are popular among OFWs because they provide a variety of investment options and are managed by professional fund managers who have expertise in investing. Both of them can be defined as pooled investments that generate income according to the performance of the fund. One of the distinctions between these two investment options for OFWs is that mutual funds are used to purchase shares, whereas UITFs are used to purchase units.

Real Estate

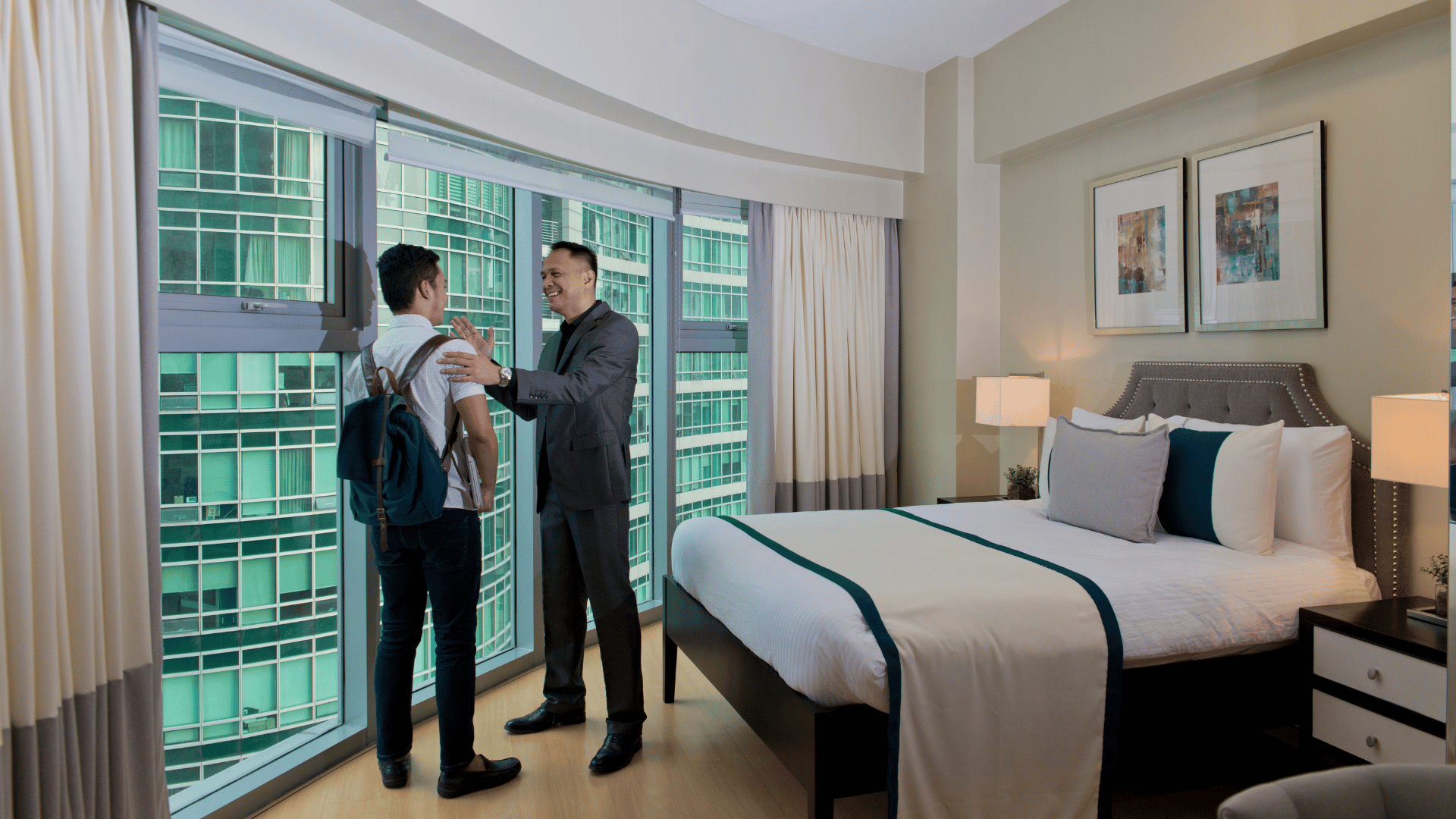

Real estate has historically proven to be a reliable investment. It provides OFWs with a tangible asset with potential for future value growth. Whether through land development projects or rental properties, the Philippine real estate market has demonstrated resilience and constant growth throughout the years, making it a dependable means for OFWs to earn passive income and take advantage of capital appreciation opportunities. You could consider making investments in real estate for residential or commercial purposes, or even investing in pre-selling condos.

6 Tips on Choosing a Prime Location for Your First Investment

A prime location is a popular or very much in-demand area for any kind of real estate that offers good foot traffic, visibility, and convenience. It can boost the value of property, attract preferred tenants or consumers, and assure steady rental income or a profitable sale. On the flip side, a poor location might lead to difficulties and financial security issues. That is why we need to be careful when choosing the location for our investment. Thankfully, here are six tips to help you out.

1. Research the local real estate market.

It is important to have enough education and understanding in order to grasp the idea of a prime location and make better decisions. That's why studying the local real estate market needs to be the first thing you do.

Pay attention to variables like demographic shifts, employment growth, and projected infrastructure development. Look for locations where the value of real estate has grown over time. Real estate investors are more drawn to areas with strong employment markets and rapid population expansion because these trends point to a brighter future and increased demand. You can use a range of resources, such as government reports, local real estate brokers, and real estate websites, to gather information about market trends.

2. Safety and Crime Rates

It's crucial to consider the security of the area when choosing the location for your real estate investment. When there is a high crime rate, it discourages potential buyers and consumers, making it challenging to get a fair return on investment.

Look for places with low crime rates and a noticeable police presence. You can find information by contacting your local law enforcement agency, using web resources, talking to locals, and consulting real estate agents.

3. Accessibility, Proximity, and Convenience

A prime location should be easily accessible to important amenities and services, as this makes it more convenient and in demand.

Pick an area for your possible investment property that is close to public transportation, hospitals, shopping centers, schools, and parks. This not only makes it easier for potential buyers or tenants to find the property, but it also makes it more desirable because of its proximity to amenities and facilities. Also, it's a plus if the location is easily accessible by car, public transportation, or foot.

4. Economic Stability and Taxes

The economic stability of the area is another important consideration. Examine the variety of businesses and sectors in the area to gauge its economic stability.

If you want to know if the area's economy is steady, it's a good idea to look at the job growth and unemployment rates. A thriving labor market can draw in potential tenants and buyers. While you're at it, keep property taxes in mind as well. Rates vary by location, and having to pay expensive property taxes might significantly reduce your potential profits. Sometimes choosing a location with a higher purchase price but cheaper property taxes makes more financial sense in the long run.

5. Future Development Plans

Investing in an area with a strong opportunity for business growth and improvement in the future is a good decision because it can result in increased property values and demand.

To figure out the long-term potential of a location, look into any prospective development plans and local zoning laws. Information about new companies, infrastructure upgrades, and urban renewal initiatives may be found on municipal websites and local planning offices.

6. Local Real Estate Regulations

More than just the area being ideal for consumers, buyers, or tenants, we should also take into consideration the real estate laws and regulations.

We should think about the real estate rules and regulations in addition to what is best for customers, buyers, or tenants.

Before making a final choice, it's essential to understand the local real estate regulations and any restrictions that may possibly apply to your investment property. These laws differ from municipality to municipality, and they may affect how easy it is to sell or rent the property if needed. Consult with the local government or a real estate attorney to ensure you have a full understanding of any zoning laws, rental limits, or other regulations that could impact your investment.

.png)